Impact of Expansionary Fiscal Policy

Readers Question: what are the impacts of expansionary fiscal policy?

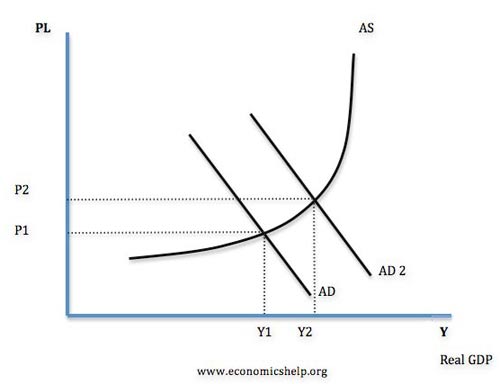

Expansionary fiscal policy involves government attempts to increase aggregate demand. It will involve higher government spending and / or lower tax. In theory, higher government spending will increase aggregate demand (AD=C+I+G+X-M) and lead to higher economic growth.

Expansionary Fiscal Policy

Lower taxes should increase disposable income of consumers leading to higher levels of consumer spending. This should also increase aggregate demand and could lead to higher economic growth.

Expansionary Fiscal policy can also lead to inflation because of the higher demand in the economy.

Expansionary Fiscal Policy and Government Borrowing

Expansionary fiscal policy will lead to an increase in the size of a government’s budget deficit. This is a potential problem of expansionary fiscal policy. Higher borrowing could:

- Cause markets to fear default and push up interest rates on government debt.

Evaluation of Expansionary Fiscal Policy

The impact of expansionary fiscal policy will depend on many factors:

- What else is happening in the economy? E.g. US tried to cut taxes in 2008. In theory, this lower tax should boost spending. However, the economy is experiencing falling house prices, lower confidence and a shortage of credit; because of all these factors expansionary fiscal policy is relatively ineffective.

Crowding Out

- Does crowding out occur? Expansionary fiscal policy involves higher spending and more government borrowing; it could cause crowding. This means that although the government spend more because they borrow from private sector, the private sector have less to spend and invest. Therefore, overall AD doesn’t increase.

Timing of Fiscal Policy

- A key issue of expansionary fiscal policy is the state of the economy. If expansionary fiscal policy is pursued when the economy is close to full capacity, then the increased government borrowing is likely to cause crowding out and / or contribute to higher inflation.

- However, in a liquidity trap, private saving rates rise rapidly. Therefore, expansionary fiscal policy helps to offset the rise in private sector saving and injects money into circular flow. In a deep recession, expansionary fiscal policy won’t cause crowding out or inflation.

Supply Side Effects

- Lower income tax may increase incentive to work

- Higher government spending on education and training, could increase long-term labour productivity. But, also government spending could be inefficient and wasteful – it depends what government spends on.

No comments:

Post a Comment