Carbon Tax – Pros and Cons

The production of carbon dioxide is widely held to contribute to social / environmental problems such as global warming. This carbon pollution is a negative externality. It is a cost imposed on the whole of society and not just the individual who consumes a certain product. e.g. if you drive a car, the external costs are felt by everyone else.

Because certain carbon intensive industries create negative externalities, the social cost of production is greater than the private cost.

In a free market, these negative externalities are not included in the price leading to overconsumption and social inefficiency. We can say there is a missing market, because the external cost of carbon emission is ignored.

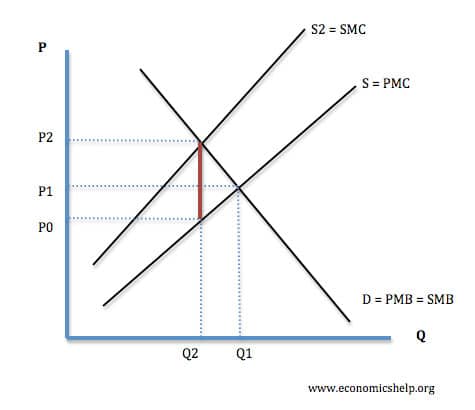

Diagram to show Welfare loss of Negative Externality

SMC = Social Marginal Cost (total cost to society) | PMC = Private Marginal Cost (cost to individual) | PMB = Private Marginal Benefit (benefit to individual)

This diagram shows that in a free market, we get overconsumption of carbon, leading to a welfare loss to society.

The Purpose of A Carbon tax

The purpose of a carbon tax is to internalise the externality. What this means is that the final price of the good should include the external cost and not just the private cost. It is similar to the ‘polluter pays principle.‘ This was incorporated into international law at the 1992 Rio Summit. It simply means those who cause environmental costs should be made to pay the full social cost of their actions.

In theory, the tax should equal the external cost. Therefore, the price consumers pay will be the social cost.

Demand will fall and the new equilibrium will be socially efficient because at this output, the marginal social cost equals the marginal social benefit.

Demand will fall and the new equilibrium will be socially efficient because at this output, the marginal social cost equals the marginal social benefit.

Diagram to Show Carbon Tax

The tax shifts the supply curve from S1 to S2. With the tax, consumers now face the full social cost (SMC)

Revenue Neutral

In theory a carbon tax should be revenue neutral. This means the tax raised from taxing carbon emissions can be used to reduce other taxes. There should be no overall increase in the tax burden. The aim is to increase social efficiency by making people aware of the full social cost.

Benefits of Carbon Tax

1. Encourages alternatives. A higher price of carbon emissions will encourages firms and consumers to develop more efficient engines or alternatives to consuming carbon emissions. For example, with carbon taxes, it will be more efficient to develop hydrogen engines or solar power.

- Itmight encourage more people to cycle or walk to work. This would have health benefits such as lower risk of heart attack.

- This could make it more feasible to generate electricity from green sources (e.g. solar power). If we develop more green sources it will also make us less reliant on oil.

- It will help make the transition to a post oil economy easier.

2. Raises Revenue. The revenue raised from carbon tax could be used to subsidise alternatives such as green electricity or the revenue raised could be used to repair the damage caused by environmental pollution.

3. Leads to a socially efficient outcome. It makes people pay the social cost and overcomes the excess consumption.

Problems of Carbon Tax

- Production may shift to countries with no or lower carbon taxes. (so called ‘pollution havens’)

- The cost of administrating the tax may be quite expensive reducing its efficiency.

- Difficult to know the level of external cost and how much the tax should be.

- Possibility of tax evasion. Higher taxes may encourage firms to hide carbon emissions.

- If demand is price inelastic, the tax may have to be very high to reduce demand significantly. In the short term, firms may not feel they have many alternatives. Though other time, demand will become more elastic as more alternatives are generated.

- Consumers dislike new taxes and often don’t believe that they will be ‘revenue neutral’. This is not an economic argument, but it is a political reality and explains why it is often difficult to implement.

- A global carbon tax may curtail economic activity in the poor developing world because they can’t afford the small increase in energy costs, but the developed world may simply be able to pay. There may be need for a carbon tax to reflect different abilities to pay.

Carbon Tax vs Cap and Trade

Related

- 10 Reasons not to cut petrol tax

- Tax on unhealthy foods

- Polluter pays principle

No comments:

Post a Comment